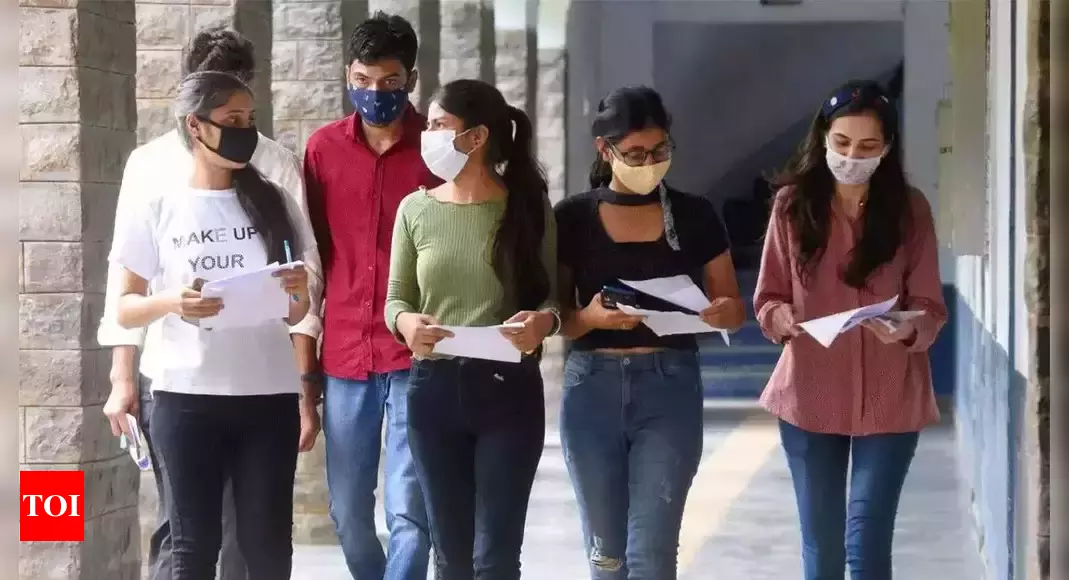

Commerce students are enrolling in short courses in digital banking and cyber security to strengthen and participate in the fast-growing banking system. These courses aim to address the potential threats in the online banking system and enhance students’ employability in the e-banking sector.

These short courses offer students diverse career options, such as security analyst, internal auditor, stock analyst, and more. However, to stay relevant in the field, students must continue upskilling themselves by enrolling in short-term courses that cover new technologies. As digital banking continues to expand, the demand for technological expertise is also increasing.

Ketan Upadhyay, the dean of the Faculty of Commerce at Maharaja Sayajirao University, Vadodara, explains that private and public sector banks are encouraging customers to adopt digital banking to reduce footfall in branches. As a result, most students are now learning digital banking courses alongside their basic commerce degree. The demand for skilled professionals in digital banking has risen, especially after the pandemic. The Bachelor of Commerce (B Com) syllabus now includes a strong emphasis on digital banking in the Insurance and Banking subject, with an advanced module available at the master’s level.

The B Com syllabus has been revised to include cybersecurity courses alongside digital banking to regulate the increasing threats of financial fraud and cybercrimes. Upadhyay further explains that the digital banking domain is continuously evolving due to technological advancements. Additionally, there is a focus on “Green Banking,” which students must learn to promote paperless banking. Internships at the Bank of Baroda provide BCom undergraduates with hands-on training in digital banking products.

Ajay Kumar Singh, the head of the Department of Commerce at the University of Delhi, emphasizes the importance of teaching digital banking to students so that they can address the challenges that arise in this field. After gaining knowledge in digital banking, students can find employment in fintech companies like Paytm, Bharat Pay, and Google Pay. They can also work to innovate digital products. The curriculum of the digital banking course combines topics from banking and technology and is offered at both the undergraduate and master’s levels, providing graduates with the necessary skills for fintech jobs.

The curriculum of the digital banking course includes an in-depth analysis of subjects such as internet banking, mobile banking, ATM, forex settlement, cryptocurrency, artificial intelligence, machine learning, deep learning, and more.

Singh mentions that currently, the university does not provide a specialization in digital banking for professional bankers. However, a financial inclusion committee was recently formed at the university, which conducted a workshop on financial inclusion with the participation of senior officials from the Securities and Exchange Board of India (SEBI).

Over the past five years, the placement opportunities for graduates specializing in digital banking have increased. Nearly 90% of MBA students specializing in digital banking receive offers from banks and prominent UPI apps. Fresh graduates in this field can expect initial salaries ranging from Rs 8 to 10 LPA.